Industry Qa With Ken Gulliver Founder And Ceo Of Ugru Coaching

1. Provide an overview/ description of your industry. Include reasons why it’s a great industry to start a business in today.

What is a Financial Coach?

Financial Coaches create positive and real financial changes in people’s lives by helping them:

- Stop the financial pain associated with budgeting and debt

- Prevent bad money decisions with good financial knowhow

- Build good financial habits

- Find value in themselves

- Confidently set higher goals

- Find money they didn’t think they had

- Save money they didn’t think they could

- Address finances they feared discussing with others

Why is a Financial Coach important?

Traditional Financial Services is the least trusted of all professions in the USA. People are tired of:

- Blindly listening and getting burned

- They are tired of getting products pushed down their throat and…

- They are tired of over paying for a service that under delivers

American’s now know that products and performance have very little (10%) to do with what REALLY builds wealth. It’s the habits and behaviors that precede the decisions they make (the 90%) that TRULY builds wealth and Financial Coaching is exactly what’s needed to remedy the Great American Household Financial Crisis.

Why would someone hire a Financial Coach?

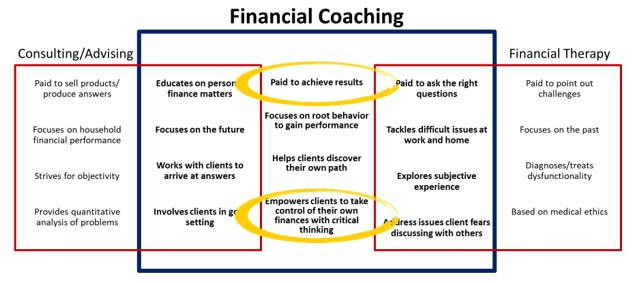

A personal coach not only covers the most important aspects a financial advisor or therapist addresses, but also focuses on empowering clients to take back control of their finances.

If you think about the options, the business model of other professionals is designed to keep them buying more product. The longer they work with them, the more they have of what the professional sells them.

A financial coach gets paid to achieve results, not from selling financial products.

There are many alternatives to build the financial knowhow and emotional capacity needed for financial freedom. But, they pale in comparison to how a Financial Coach can set someone up for success.

2. How has your industry changed in the last 10 years? 20 years?

Financial Coaching is a very new industry with very little widespread standardization. We believe UGRU is positioned to be the gold standard in financial coaching.

3. What trends do you see in your industry over the next 5 years? Next 10 years?

I see the industry becoming more standardized with business and coaching processes

4. What is the biggest concern about your industry that a franchisee candidate should be aware of and investigate?

Imposter syndrome. Feeling like an "imposter" may very well be the most pervasive feeling you will have as a financial coach. That's why we have worked diligently to create a training and platform that prepares you with the tools, education and resources you need for confidence and authority to step out as a financial coach.

5. Why do you think your company stands out in the industry?

1. The industry is currently comprised of solo practitioner’s that have hobbled together their own curriculum, technology, pricing, agreement etc. There is really no one company that has created a turn-key financial coaching program like UGRU that we are aware of.

2. Most every current financial coach is working with their clients to improve their financial behavior around budgeting and becoming debt free. We believe this is good and train our coaches in these areas, give them the educational format and tools to be successful at that, but a huge differentiator is that we arm them with proprietary software and teach them how to solve complex financial decisions with relative ease.

6. What makes your franchise/ business opportunity more attractive than your competitor’s?

At the moment the competition is really bare but the biggest attraction is that we are a complete turn-key system.

7. Describe the ideal candidate. Do you think your requirements are any different than your competitor’s?

We want you to have a story. Does your story give hope to others you’re trying to help? Are you passionate about touching people’s lives in a positive way? Are you ready for success? If you answered yes to these questions, you may have found your life purpose as a UGRU trained financial coach. Let’s talk!

8. What's the strongest skillset you require in a candidate?

- A fast learner

- Strong communication skills

- Numbers geek

- Problem solver

- An active listener

- A natural observer

- Goal oriented

- On task

9. Describe the working environment of your franchisees (indoors, home office, mobile, etc...). Is your environment typical of other companies in your industry?

Working environment can be anywhere in the world. If you have a strong internet connection, laptop and headset, you're able to engage your clients.

10. How much experience in this industry should a franchisee candidate have should they consider buying a franchise in your industry?

Having experience can be very helpful if you have previously been a life or business coach. If you have operated as a traditional financial advisor you may have a little challenge wrapping your head around the idea of coaching but it is possible. Often times someone with no experience is best suited as long as they have a passion for personal finance, outgoing, results oriented and a heart for helping others. Everything else is trainable.